how much federal taxes deducted from paycheck nc

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. North Carolina Deductions From Pay.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

North Carolina Payroll Taxes North Carolina payroll taxes are as easy as a walk along the outer banks.

. Discover Helpful Information And Resources On Taxes From AARP. For a hypothetical employee with 1500 in weekly. Your employer pays another 62 percent on your behalf.

The amount of taxes to be. Therefore a taxpayer must determine federal adjusted gross income before. For tax year 2021 all taxpayers pay a flat rate of 525.

Standard deduction or NC. In most cases your state income tax will be less if you take the larger of. Taxpayers can receive a deduction of up to 2500 for each qualifying child depending on income and filing status.

And just like the North Carolina Form NC4 keep Form W-4 for your records. Everything is included Premium features IRS e-file Itemized Deductions. The 2021 standard deduction allows taxpayers to reduce their taxable income by 10750 for single.

1 2005 a deduction of 50 will be made from your paycheck dated. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income. Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee.

Ad Deductions for Healthcare Mortgage Interest Charitable Contributions Taxes More. An individual who receives 277050 net salary after taxes is paid 300000 salary per year after deducting State Tax Federal Tax Medicare and Social Security. Withhold half of the.

2 2005 the retail company provides Sally with a written notice stating Per your signed authorization dated Nov. North Carolina moved to a flat income tax beginning. The calculator reflects known rates as of June 1 2022.

Standard Deduction The state of North Carolina offers a standard deduction for taxpayers. NC Tax Calculations Click. Dont send it to the IRS.

You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. That is a 10 rate. While they are little things that not many people think about your business thrives on these tiny details and therefore you are able to have tax deductions on them.

There is a flat income tax rate of 499 which means no matter who. Your 2021 Tax Bracket To See Whats Been Adjusted. You fill out a pretend tax return and calculate that you will owe 5000 in taxes.

For Medicare you both pay. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. North Carolina moved to a flat income tax beginning with tax year 2014.

As of 2015 FICA taxes for Social Security take 62 percent of your salary up to 118500. Lets look at how to. Additional Medicare Tax Some employees will have to pay the 09 Additional Medicare.

Ad Compare Your 2022 Tax Bracket vs. You may deduct from federal adjusted gross income either the NC. The starting point for determining North Carolina taxable income is federal adjusted gross income.

North Carolina Income Taxes. You can have 10 in federal taxes withheld directly from your pension and.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

Federal Tax Cuts In The Bush Obama And Trump Years Itep

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

2022 Federal Payroll Tax Rates Abacus Payroll

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How Much Does A Small Business Pay In Taxes

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

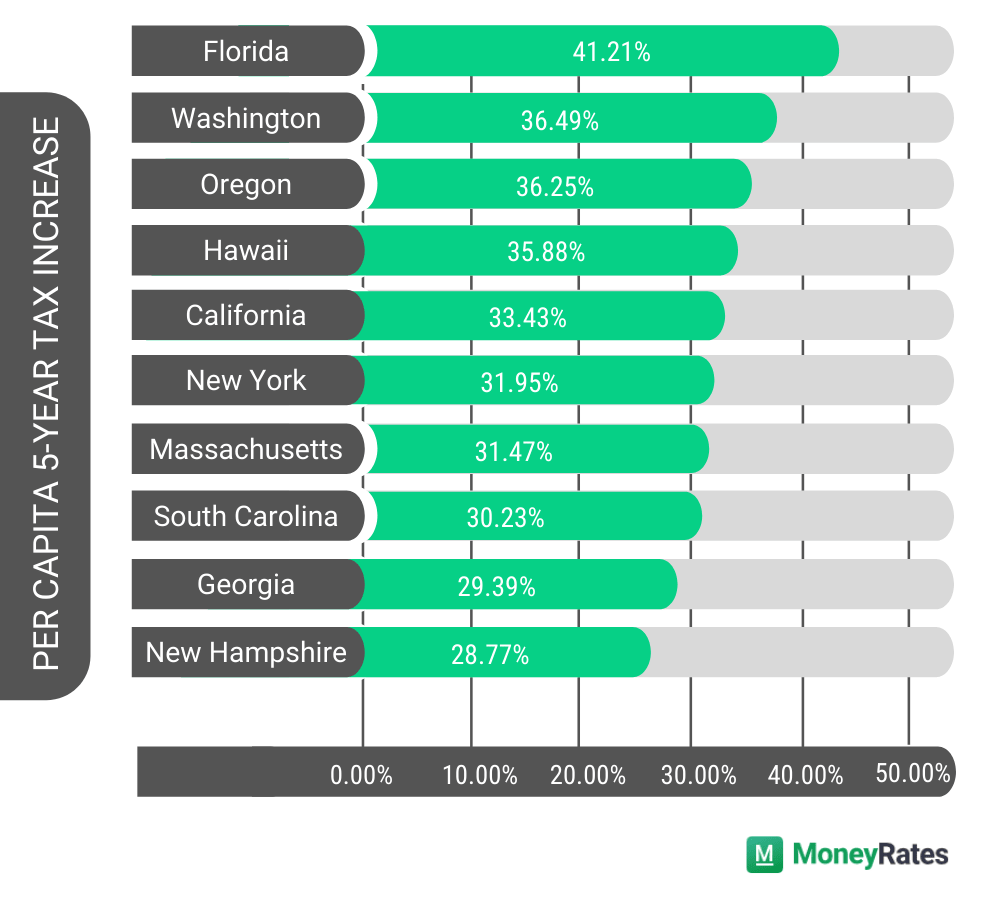

Which States Pay The Most Federal Taxes Moneyrates

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2022 Federal State Payroll Tax Rates For Employers

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation